- How may I help you?

- 8233970000

- 9829016449

- info@ipsedu.in

How to Prepare for a Tech Driven Finance Industry?

When the first industrial revolution happened, capital was considered to be the most important resource before knowledge took over. It was recognized that knowledge is a resource and its impact on organizational knowledge was immense. Undoubtedly, knowledge is power but knowledge keeps changing its forms. Knowledge about finance ruled the industry for decades but an era has commenced where technology would rule finance to a large extent.

Developing the Right Skill:

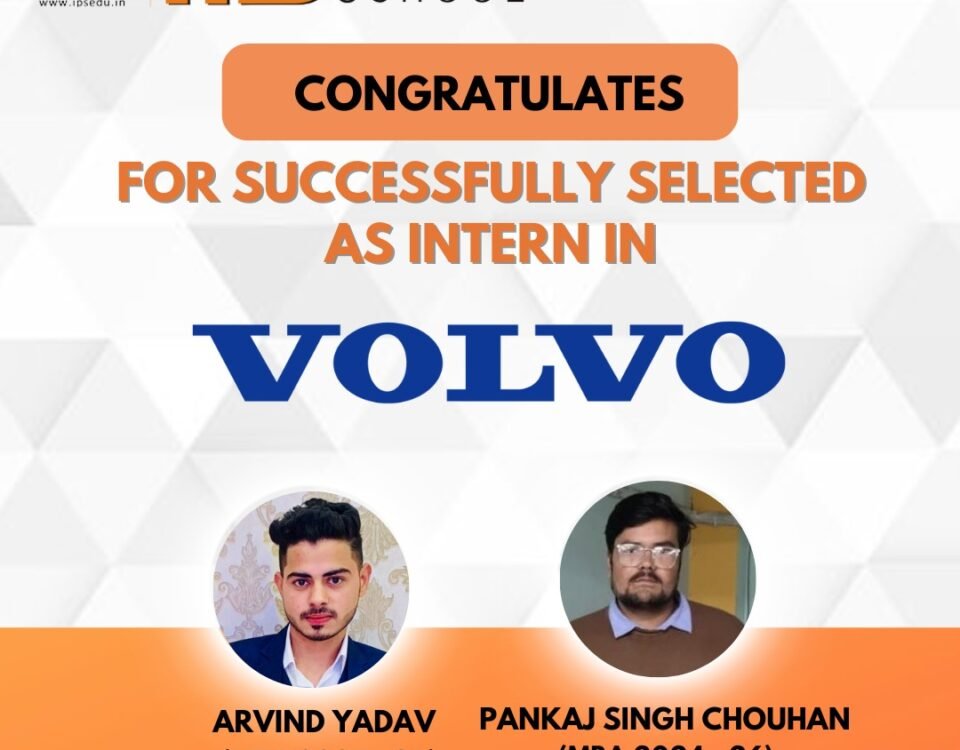

- The employability of MBA students which remained intact at IPS BUSINESS SCHOOL is truly an indication of the quality of students graduating from IPS BUSINESS SCHOOL.

- Quality is impacted predominantly due to lack of skills. In the past few years, technological advancements have happened quickly, leaving no place for ‘wait and watch’ or ‘trial and errors’. Successful organizations are the ones who have been able to go with the flow, embracing the change and putting it to the best of their advantage. A tech driven industry needs tech driven professionals too. Thus, it is the responsibility of all B-schools to prepare students for technology disruptions like artificial intelligence, blockchain, automation, and big data which can be used for creating new business models and acclaimed innovations and most importantly, their application.

Emphasizing On Application of Concepts:

- B-schools face two types of issues while training finance students. First, many of them are from non-finance educational background, so, getting them acquainted with the domain knowledge is important. Second, those from the finance background are too confident that they know it all, so ‘unlearning and learning’ for them is critical.

- With the advent of technology, both these clusters need to be trained on understanding finance with technology in the forefront and the real challenge lies here. Take an example, in order to understand how the application of blockchain could modify the scope of audit even for a statutory audit, the student should first understand how systems audits are done and should then be able to apply this knowledge in the context of block chain to arrive at meaningful results. While both concept and applicability of the concept is important, a skill set to execute the same is paramount.

- At IPS BUSINESS SCHOOL we focus at the real gap - application of concepts. Usually students are unable to relate a concept to real-life. This skill is developed at IPS BUSINESS SCHOOL by making them discuss more about recent articles and creating an understanding of what the business needs. Students are taught to be agile and have the right attitude to embrace change. Thinking differently is encouraged.

- Data is only as good as the skills of the interpreter. If a student is given customer data on credit cards, he/she should be able to draw multiple inferences out of it by using analytics. Students are trained at IPS on data mining and predictive modelling techniques to interpret the data set. When Ola launched in-trip insurance for riders @ INR 1, they would have analyzed their data to arrive at this value. Although the amount seems miniscule, the same would have a positive impact on its bottom line but this was only possible when someone analyzing this data was able to capture it.

Encouraging Decision Making Using Analytics:

- At IPS BUSINESS SCHOOL we encourage decision making with the use statistics as it helps in ensuring a good understanding of various analytical tools and enable students perform longitudinal analysis better and also help them interpret results using analytics better.

- Tableau needs an understanding of statistical tools for decision making and regular training on these tools at IPS makes the students swift, alert and quicken their performance in number crunching.

- Regular discussions on fin-tech during sessions focusses #IPSians attention on existing vs future technologies which is further supplemented by organizing online fin-tech events where the #IPSians get an opportunity to listen to industrial perspective which results in budding of fresh ideas in young minds.

Eliminating Redundancies:

- Three decades ago, when computers were introduced in banks, SBI employees went on a strike assuming there would be layoffs due to the machine. Gradually when they were trained to work on computers, they realized it was a blessing and those who managed to upgrade themselves never faced the axe. Every time a new technology is introduced, there are redundancies in the system which need to be addressed. Students should be made to understand how these redundancies can be overcome.

- At IPS, we help students identify the gap and focus on developing the skill set so that once they join the workforce, they are an asset to the organization (which they want to retain for long) and not a liability which they want to get rid of.

- It is needless to say that the millennials are already tech-friendly due to early exposure to gadgets like smart phones, e-commerce, and online banking sites. IPS BUSINESS SCHOOL is always committed to identify the need at the right time to guarantee shaping of careers in the best possible way!